State News

Massachusetts

Massachusetts is one of the most active states in monitoring healthcare spending and encouraging policies to address unwarranted price variation and uneven quality. The state’s all-payer claims database (APCD) has been collecting data since 2009, providing key insights into the state’s healthcare system.

In 2012, Massachusetts passed a far-reaching cost containment law that included: better monitoring and tracking of spending throughout the healthcare system; transparency provisions to increase availability of price lists from insurers, hospitals and physicians; and a voluntary target for annual increases in healthcare spending, designed to match the state’s long-term economic growth. More recently, in 2016, the state legislature established the Special Commission on Provider Price Variation to investigate the extent of price variation to determine feasible next steps to address variation. In 2018, the Center for Health Information and Analysis (CHIA), launched a new online transparency website that includes procedure pricing comparisons, provider quality metrics and other resources to help consumers better shop for quality healthcare.

Although Massachusetts residents continue to be burdened with high healthcare costs, yearly cost growth from 2013 has been consistently below the 3.6 percent benchmark set by the Health Policy Commission, and lower than the national average, indicating that reforms put in place have been working.

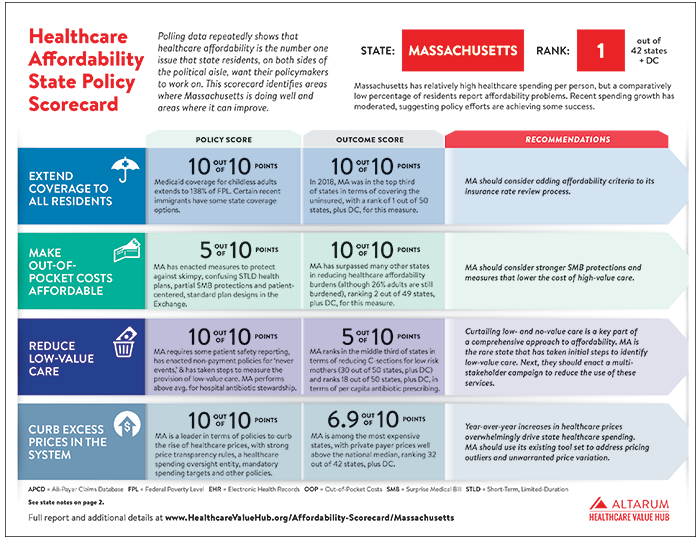

Massachusetts ranked 1 out of 47 states plus DC, with a score of 65.3 out of 80 possible points in the Hub's 2021 Healthcare Affordability State Policy Scorecard.

Food or Medicine? Fall River Residents Face Tough Choices as Health Care Costs Surge

A draft of the 2024 Health Care Cost Trends Report from The Massachusetts Health Policy

Commission suggests that residents living in Fall River have felt a surge of healthcare costs. A

survey by the Center for Health Information and Analysis found that over half of the state’s low-

income residents with employer sponsored insurance coverage said it was challenging to

afford care. The full Health Care Cost Trends Report will be released Oct. 10, 2024.

Massachusetts Passes Maternal Health Bill

Massachusetts passed a new maternal health law aiming to improve birthing outcomes, reports

WPRI. The law provides pathways to doula and lactation consultant certification, increases

access to postpartum depression screening, and removes barriers to opening birthing centers.

Despite 98 percent of Massachusetts residents having health insurance, and despite the state

recently being named the best state in the country for women, the rate of severe maternal

morbidity almost doubled over the last decade. This is especially true for women of color, as

black women have astronomically higher rates of complications. This law looks to address this

inequity by providing access to services more often used by people of color, such as doula and

midwife care.

ConnectorCare pilot expansion creates lower costs, better access to health care for 51,000 residents

A new report finds the ConnectorCare pilot expansion enabled access to lower-cost health

insurance to over 51,000 Massachusetts residents and many new participants benefit from the

program’s financial protections, according to the Massachusetts Health Connector. The pilot

expansion is available to residents for calendar years 2024 and 2025 and lifted income eligibility

limits to the program from 300 percent to 500 percent of the federal poverty level. The report

details an increase in member cost savings and member utilization of their coverage.

Massachusetts Receives Approval for 1115 Waiver to Make Health Care More Equitable and Affordable

The federal government has approved Massachusetts’ 1115 Waiver, which will make health

care more accessible, affordable, and equitable for hundreds of thousands of Massachusetts

residents, according to the Office of the Governor. The Waiver enables Massachusetts to

expand health insurance subsidies to individuals who are not otherwise eligible for Medicaid or

CHIP, offer services that are not typically covered by Medicaid, and to use innovative service

delivery systems to increase efficiency and affordability of care.

Department of Public Health Launches Health Equity Plan to Address Racism as a Serious Public Health Threat

The Massachusetts Department of Public Health (DPH) has launched a strategic plan to

advance racial equity in all the work DPH undertakes and oversees, providing an action-

oriented roadmap to address underlying concerns that have perpetuated health inequities

across the state. The Strategic Plan to Advance Racial Equity is a call for action and

accountability to address the systemic inequities faced by people who identify as Black,

Indigenous, Latino and/or Asian or Pacific Islander, seeking to acknowledge, transform, and

improve the public health outcomes of all people in Massachusetts. The plan calls for

implementing a data equity framework, supporting a racial equity training series for staff, and

establishing a racial equity staff survey to enable staff to fully participate.

Health Care Costs in Mass. Rose Sharply Again in 2022

A new report finds health care spending in Massachusetts increased 5.8 percent in 2022, well

above the state’s 3.1 percent benchmark, reports WBUR. The growth rate represents the

largest one-year jump since measurement began in 2012, aside from pandemic anomalies. The

2022 growth was below both the rate of growth in the Massachusetts economy broadly and for

regional inflation, but outpaced growth in both national wages and salaries and national health

care spending. The largest contributors to the 2022 expenditure increases were pharmacy

spending and non-claims payments. Hospital services accounted for the greatest share of

2022's total health care spending, with outpatient spending increasing 5 percent from 2021 and

inpatient spending declining 1.4 percent.

Health Care Inequities Persist on Race, Class Lines Across Massachusetts

A report released by the Blue Cross Blue Shield of Massachusetts Foundation finds racism is

preventing people of color, and those who don’t speak English as their primary language, from

receiving the same quality of healthcare that white people get, reports Mass Live. While the

report notes the progress that has been made toward addressing the cause and effects of

racism, there is still more work to be done. Efforts need to be coordinated and bring

stakeholders together in new ways, according to the foundation.

Changes to Dental Insurance Regulations to Take Effect in 2024

New dental insurance regulations are slated to take effect in Massachusetts at the start of the

new year, 14 months after the measure was approved by voters, reports WCVB. The

regulations require insurers to provide refunds to members if the insurer spends less than 83

percent of premiums on members’ expenses. Insurers will also be required to file base rates

and rating factors, which will be subject to approval by the insurance commissioner.

Health Policy Commission Finds Health Care Costs Burdens on Residents

The Health Policy Commission (HPC) published annual health care cost trends reports,

showcasing a wide range of data points that reveal significant strain on patients and employers,

reports WWLP 22 News. The report found health care costs growing faster than wages and that

the pace of spending growth is faster in Massachusetts than the national average. The HPC

recommended greater regulatory scrutiny of pharmaceutical companies, producing affordability

and equity targets, and strengthening its enforcement mechanisms.

Massachusetts Expands ConnectorCare Eligibility

The Massachusetts Health Connector approved a two-year pilot program expanding income

eligibility limits to 500 percent of the federal poverty level, up from 300 percent, according to the

Massachusetts Health Connector. This expansion is estimated to impact over 50,000 people.

This change comes after the 2024 state budget was signed, which included the income limit

expansion and requiring all Marketplace carriers to participate in the program.

Health Disparities Facing People of Color in Massachusetts costs $6 Billion per Year

Communities of color in Massachusetts experience nearly $6 billion in avoidable annual health care spending and lost labor productivity due to poor health and the cost of premature death, according to a new study, reports Mass Live. The study, commissioned by the Blue Cross Blue Shield of Massachusetts Foundation and the Health Equity Compact found premature deaths among residents of color cost $3 billion dollars, avoidable health care spending costs $1.5 billion, and lost labor productivity costs another $1.4 billion across a variety of industries. Without action, authors warned that inequity costs will nearly double in a single generation, reaching $11.2 billion annually in today’s dollars by 2050.

Annual Report on Performance of M.A. Health Care System

Massachusetts’ Center for Health Information and Analysis released its latest annual report on the state’s health spending, reports AboutHealthTransparency.org. Following a decrease in spending in 2020 due to the pandemic, health spending increased 9 percent in 2021. Pharmacy spending grew the fastest between 2019-2021, at an annualized rate of 7.5 percent. Additionally, among private commercial plans, enrollment in high deductible health plans increased by 4.1 percent, along with member cost-sharing growing 16.9 percent.

Report Details Telehealth Digital Divide in Massachusetts

There exist large disparities in telehealth usage in Massachusetts, specifically by age, internet accessibility and rurality, reports Healthcare Innovation. These revelations come from a report by the Harvard Pilgrim Health Care Institute, which found that seniors, children and people who live in rural areas were less likely to use telehealth during the pandemic. Telehealth use was also lower in communities where fewer households had home internet access. The report also found that telehealth greatly enabled access to primary, chronic disease and behavioral healthcare during the pandemic, making the uneven uptake more alarming. Furthermore, lower quality experiences with telehealth were associated with gaps in broadband infrastructure, digital affordability and in the usability of technological platforms.

Connector Tying Copay Relief to Health Conditions

Officials at the Massachusetts Health Connector have put forward a framework for their 2023 health insurance offerings that would eliminate sick visit copays and cost-sharing on common medications for four chronic conditions for patients enrolled in ConnectorCare plans, reports WWLP. Each year, the Connector sets parameters for plans sold through the insurance marketplace and establishes design elements of the ConnectorCare program, available to residents with incomes at or below 300 percent of the federal poverty level. In the upcoming year, officials are proposing $0 cost-sharing in the ConnectorCare program for diabetes, asthma, coronary artery disease and hypertension—conditions that disproportionately impact communities of color. Other “equity-minded components” include efforts to enhance behavioral health access, minimize barriers to gender-affirming care and ensure access to care for people with limited English proficiency.

As America's Biggest Health Systems Expand, Some Warn Patients Will Bear Higher Healthcare Costs

Massachusetts' largest and most expensive hospital system is seeking to expand, spotlighting quesitons about whether such expansions by big health systems are driving up healthcare costs, reports Fortune. Mass General Brigham, which owns 11 hospitals in the state, has proposed a $2.3 billion expansion, which includes a significant expansions. The most controversial element, however, is the plan to build three ambulatory care centers, offering physician services, surgery and diagnostic imaging, in three suburbs west of Boston. Massachusetts' Health Policy Commission unanimously concluded that these expansions would drive up spending for commercially insured residents by as much as $90 million a year and boost health insurance premiums. The Commission also ordered the health system to develop an 18-month performance improvement plan to slow its cost growth.

Health Cost Regulator Reprimands Dominant Mass. Hospital System

For the first time, the Massachusetts Health Policy Commission has taken action on a hospital system in an attempt to rein in healthcare costs, reports Axios. The Commission is requiring Mass General Brigham (a dominant, tax-exempt academic hospital organization with $16 billion of annual revenue) to submit a plan to lower rising costs that stem from the system's expensive care. Indeed, the Commission claims that the system's high prices (the highest in the state) and market power has led to residents paying a lot more in health insurance premiums and taxes, and that the high spending will impat the state's ability to meet their benchmark of lower cost growth. The system has 45 days to submit a performance improvement plan explaining how it will address the underlying causes of its high costs. If they fail to do so, the Commission may levy a $500,000 fine.

Commission Orders Mass General Brigham to Reduce Spending

The Massachusetts Health Policy Commission unanimously voted to issue a performance improvement plan to Mass General Brigham, reports Modern Healthcare. Mass General Brigham is the largest health system in the state and has spent $293 million in excess of Massachusetts’ cost growth benchmark from 2014 to 2019. The main driver of this spending growth was prices and its payer mix, rather than utilization. This is the first time the Health Policy Commission has used this power, and the system has 45 days to provide a performance improvement plan, request a waiver or apply for an extension.

State Health Policy Commission Recommends Cost Controls

After the second consecutive year that healthcare cost growth exceeded a state target, Massachusetts’ Health Policy Commission recommended a series of steps intended to respond to the continually rising cost of care, reports the State House News Service in the Patriot Ledger. The recommendations, from the Commission’s annual cost trends report, include price caps for the most expensive providers, greater scrutiny around hospital outpatient and ambulatory care expansions and new affordability standards for health plans. The Commission noted that price growth is a primary driver of the state’s overall spending growth and that premiums and out-of-pocket spending are rising faster than incomes.

Survey: Government Action Needed to Ease Health Cost Hardships

More than half of Massachusetts adults said they had experienced healthcare cost hardship in the past year, and almost three-quarters said they were worried about their ability to afford care in the future, according to a State House News Service article in The Patriot Ledger. Results were drawn from the Altarum Healthcare Value Hub’s CHESS survey.

A Community Health Worker Intervention Reduces Hospital Readmissions

The Community CAre Transitions (C-CAT) clinical trial, which paired community health workers with patients admitted to Massachusetts General Hospital, found that fewer intervention group participants were readmitted within 30 days than control group participants. The study, published in JAMA Network Open, revealed a significant effect for patients discharged to short-term rehabilitation but not for those discharged home. In the study, community health workers trained in basic knowledge of clinical conditions provided health coaching and connected patients to specific low and no-cost resources (like food, transportation and housing) that were contributing to gaps in their care, seeking to strengthen patient connections to primary care while addressing unmet needs. Just 12.6 percent of intervention group participants were readmitted in the 30 days following hospital discharge, compared to 24.5 percent of control participants. In addition, fewer intervention than control patients had missed appointments (22% vs. 33.7%) and ED visits (11.2% vs. 16.8%).

An ‘Automatic’ Solution to Keep People from Losing Health Coverage

An old Massachusetts policy called “automatic retention” stopped residents from losing their health coverage, reports Tradeoffs. The results of an NBER working paper show that this unique feature protected 14% of adults per year from losing health insurance coverage due to payment lapses. Because in CommCare (Massachusetts’ pre-ACA health insurance exchange) there was always one plan option with zero premium available to people making 100-150% of the federal poverty limit, if someone missed a payment for another plan, they were switched automatically to the premium-free plan. Researchers found that the adults who benefited from this policy were often younger and healthier, keeping the market risk pool balanced.

When the Unexpected Happens: A Lifeline, John L.

John often lacks benefits or health insurance because he is self-employed and frequently works in construction, landscaping or general maintenance work, reports That's Medicaid. Now in his early 60s, John was living with a hernia for years, until it became strangulated and sent him to the emergency room and into surgery. After being discharged, he feared being set back by the cost of the operation, but a local nonprofit helped him apply for Medicaid. John will be on Medicare in a few years, but Medicaid is providing him with peace of mind in the meantime and relief from otherwise large costs for his surgery.

An Inside Look: Problems Paying Family Medical Bills Are a Burden for Some

While health insurance is intended to protect families from high healthcare costs, gaps in that protection remain for Massachusetts residents who are insured all year, reports the Center for Health Information and Analysis. Results from the Massachusetts Health Insurance Survey reveal that in 2019, one in seven residents (15%) who were insured all year had problems paying or were unable to pay their or their families’ medical bills over the previous 12 months. Though the type of problem medical bills ran the full gamut of services (like medical tests, procedures or prescription drugs), nearly half of residents reported problems with bills for dental care, which is not typically covered by insurance plans.

Massachusetts Governor Signs Law Safeguarding Telehealth Coverage

The Massachusetts Governor signed into law a wide-ranging bill that includes expanding access to telehealth after the COVID-19 public health emergency abates, reports Healthcare IT News. The new law mandates that insurers cover virtual behavioral health services at the same rate as in-person services, rate parity for primary care and chronic disease-management services for two years and rate parity across the board for 90 days past the end of the state of emergency. In addition, the law makes permanent measures to expand scope of practice for a wide range of providers, requires providers to notify patients in advance about whether a procedure is out of network and mandates insurance coverage for all COVID-19 related emergency, inpatient and cognitive rehab services.

Study Finds Permanent Supportive Housing Reduced MassHealth Costs for People Who Were Homeless

Providing permanent housing with support services to people who have experienced chronic homelessness reduces healthcare costs, reports WBUR news. The results, from a study by Blue Cross Blue Shield of Massachusetts Foundation, show that expenditures by MassHealth (Massachusetts’ Medicaid program) were 11.2 percent lower for people in the first year they were housed than for a control group living in shelters and on the street. People living in permanent supportive housing have case managers from social service agencies who provide additional support. Indeed, MassHealth spent 35 percent more on mental healthcare for people who had experienced chronic homelessness in the first year they were housed, the study found, which suggests that those patients were getting needed help they had previously been missing.

Massachusetts Insurers Commit to Diverse Hiring; Plan Telehealth Inequity Study

Massachusetts’ top insurance lobbying group will launch a research study and has started a pledge focused on racial disparities in healthcare, reports the Boston Business Journal. The Massachusetts Association of Health Plans, which includes 17 of the state’s insurance carriers, has created a compact among members for diversity and inclusion in the healthcare workforce. The insurance plans have committed to promoting a diverse culture, supporting workforce diversity through the creation of a pipeline to employment and developing and increasing opportunities for diverse candidates through targeted entry level healthcare jobs. The group will also sponsor a $200,000 research study looking at racial disparities within telehealth use which would seek to further understand how COVID-19 has changed telehealth usage and how insurance, socioeconomic status, race and ethnicity have further shaped use. The study, to be led by researchers from the Department of Population Medicine at the Harvard Pilgrim Health Care Institute and advisors from the state’s Health Policy Commission, will identify communities with equity gaps and develop a plan to address them.

Small Doctor Practices Struggle with Telehealth

Many Massachusetts physician groups are struggling to leverage telehealth as they continue to deal with lagging patient volumes, reports Modern Healthcare. Overall, there were more struggling small physician practices in Massachusetts than successful ones as of September and October, according to data released by the Massachusetts Health Policy Commission, as many providers found it difficult to use or clinically inadequate. Anecdotally, some providers are considering early retirement or joining larger practices.

Massachusetts Attorney General Calls for Equity in Healthcare

Massachusetts’ Attorney General hosted a discussion summarizing a new report with recommendations on racial justice and equity in healthcare, reports CapeCod.com. The report highlights longstanding disparities, as well as the disproportionate effect that COVID-19 has had on Black, Hispanic and Latinx communities. The report calls for action in five domains: data to identify and address health disparities; equitable distribution of healthcare resources; telehealth as a tool for expanding equitable access to care; healthcare workforce diversity; and social determinants of health and root causes of health inequities.

Patients Want Healthcare Price Transparency, But Few Seek it Out

Most consumers living in Massachusetts, a state with some of the most comprehensive healthcare price transparency laws, have never thought to seek out pricing information, reports RevCycleIntelligence. About 54 percent of the 500 adults in Massachusetts surveyed by the Pioneer Institute said they never thought about trying to obtain price information about healthcare services. Additionally, the survey found that only one in five consumers had ever tried to find pricing information prior to obtaining a healthcare service. The survey also shows that 70 percent of adults who obtained insurance through employers or on the open market in June 2019 did not know that their health insurance carriers had a cost estimator tool. Not only is awareness a major barrier to healthcare price transparency, but consumers may be leaving money on the table.

Massachusetts Announces $1.5 Million Grant Program to Support Opioid Treatment for Communities of Color

The Massachusetts Attorney General is launching a new grant program that aims to promote equity for treatment of opioid use disorder by supporting recovery programs in communities of color, reports the Boston Globe. The $1.5 million program is being funded by the recent settlement the state reached with an Andover mail-order pharmacy whose alleged actions fueled the opioid crisis in the state. The program will fund recovery and behavioral health services that are, “committed to standards that serve Black, Indigenous and People of Color (BIPOC) communities,” in the state, with organizations based in the communities they serve getting priority. The program seeks to remove barriers to treatment that have systematically and disproportionately harmed such communities.

Community-Level Factors Associated with Racial and Ethnic Disparities in COVID-19 Rates in Massachusetts

Across Massachusetts’ cities and towns, Latino and Black communities are experiencing higher rates of COVID-19 cases, and a recent study in Health Affairs identifies important factors that are independently associated with higher COVID-19 case rates in the state. The proportion of foreign-born, non-citizens was the strongest predictor of the burden of COVID-19 cases within a community, while household size and food service occupation were also strongly associated with the risk of developing COVID-19. Some factors, however, such as occupation in an essential service field, did not affect Black and Latino communities in a similar matter. The authors posit that other factors not examined in the study, such as structural inequities like disproportionately high incarceration rates, residence in areas with a higher concentration of multi-unit buildings and defacto neighborhood segregation, may contribute to the spread of COVID-19 in Black communities.

Rewards, Cash-Back Programs Recommended to Incentivize Lower Healthcare Spending

Payers can reduce unnecessary healthcare spending by incentivizing consumers to choose lower-cost healthcare providers, reports HealthPayerIntelligence. Focusing on Suffolk County, Massachusetts, the study from the Pioneer Institute used data from the Massachusetts Center for Health Information and Analysis to track resident healthcare spending on 16 services. They compared the cost difference between services used in 2015 and what they would have been had residents gone to lower-priced providers. The health system could have saved nearly $22 million in one year. To incentivize members to transition toward lower-cost providers, researchers recommend rewards and cash-back programs.

Massachusetts Adopts Permanent Telehealth Policy for the First Time

The Massachusetts Board of Registration in Medicine has approved its first permanent telehealth policy, having previously approved the same policy on an interim basis in March 2020, reports JD Supra. The policy provides that a ‘face-to-face encounter’ is not a pre-requisite for a telehealth visit and that the same standard of care applies in both in-person and telehealth encounters. This permanent policy change is one of the first state actions to make permanent some of the temporary measures that were put in place to facilitate telemedicine use during the COVID-19 pandemic.

Expanding Access to Behavioral Healthcare Through Telehealth: Sustaining Progress Post-Pandemic

A 2019 report by Blue Cross Blue Shield of Massachusetts Foundation revealed that the state struggled to provide adequate access to behavioral health services despite having a high density of primary care practitioners and psychiatrists, an innovative Medicaid coverage and delivery system and a high rate of insured residents. The report noted opportunities to expand telehealth to improve access to these services. The Foundation’s latest report explores this telehealth potential, proposing a framework for an optimal telebehavioral health system of care, highlighting barriers to adoption for providers and consumers and identifying opportunities to promote and expand access across the state.

Massachusetts Physician Practices Considering Closure, Consolidation

Around 30 percent of physician practices in Massachusetts have been considering closing down, according to a preliminary report by the Massachusetts Health Policy Commission and the Massachusetts Chapter of the American College of Physicians. Medical and procedural specialist groups were the most likely to consider closing their practice at 42 percent, while around 20 percent of primary care and behavioral health physician groups were weighing closure, Modern Healthcare reports.

Massachusetts Will Spend $800 Million to Shore Up Hospitals and Other Healthcare Providers

Massachusetts will direct another $800 million to the state’s healthcare industry, supplementing $840 million in previously announced assistance as the state works to bulk up its front line of defense against COVID-19, according to WGBH. Half of the new funding will be split between 28 safety-net and high-Medicaid-population hospitals. This plan will also increase rates paid to hospitals for COVID-19 care by 20 percent and 7.5 percent for all other hospital services. The Massachusetts Health and Hospital Association estimated that hospitals across the state are losing $1 billion per month due to the pandemic as revenue has “evaporated.”

Record Number of People Using Massachusetts Health Connector

Open enrollment for the Massachusetts Health Connector has come to a close with a record number of people signing up, according to WWLP.com. More than 312,000 people are now enrolled for affordable coverage through the connector – 57,000 new people signed up this year, adding to a 91% retention rate from last year’s enrollment.

Report Tracks Highest-Cost and Most-Used Prescription Drugs in Massachusetts

Just 10 treatment categories of drugs, including anti-asthmatic, cardiovascular and antiviral, accounted for over 70 percent of Massachusetts pharmacy claims from 2015 to 2017, according to MassLive. These statistics are available in a report on prescription drug use and spending from the Center for Health Information and Analysis (CHIA), an independent state agency that monitors the performance of Massachusetts’ healthcare system. The report found that anti-inflammatory tumor necrosis factor inhibiting agents, like Humira and Enbrel, which are used to treat difficult-to-manage diseases like rheumatoid arthritis, accounted for the largest portion of spending.

Rising Inpatient Acuity May Not Mean Patients Are Sicker, Mass. Commission Finds

While higher inpatient spending in Massachusetts has been linked to rising prices and patient acuity levels, a recent report from the Massachusetts Health Policy Commission reinforces previous findings that state residents may not actually be getting sicker, according to Modern Healthcare. Indeed, the report shows that while inpatient acuity grew by over 10 percent from 2013 to 2018, the length of stay increased only 1.5 percent. The two largest health systems in the state and the state’s Health and Hospital Association stated that new or improved EHRs have increased the ability to document diagnostic information and are a major factor in rising acuity levels and risk scores.

Years After the State Mandates Health Cost Transparency, Few Massachusetts Residents Taking Advantage of It

Few Massachusetts consumers know how to get price information before a procedure, despite the state’s 5-year old transparency provisions, according to a Becker’s Hospital Review analysis of a poll by the Pioneer Institute and DAPA Research. Indeed, seventy percent of respondents said they want to know the price of a medical service before obtaining it, though thirty-two percent of respondents said they don’t know whether their insurance company has a website or cost estimator tool that would allow them to compare out-of-pocket costs. Researchers believe this shows that though the public wants transparency in their healthcare prices, easy access is not yet a reality.

Charlie Baker's Healthcare Bill Could Make a Big Difference

Legislation aimed at overhauling Massachusetts’ healthcare system was introduced this month, according to the Boston Globe. Among other things, the legislation would require an increase in spending by hospitals and insurers of 30 percent over three years for primary care and behavioral health, without increasing overall spending. This move to reshape the delivery of services reflects the concern that less than 15 percent of total medical expenses are spent on primary care and behavioral health combined. In addition, this legislation would streamline the behavioral health provider credentialing process. Also of note, this legislation would seek to create more extensive state oversight of drugs that cost over $50,000 per person per year, even if bought through the private market.

Alternative Payment Models Fail to Control Costs in MA

A report from Massachusetts’ Attorney General finds that alternative payment models did not shift care to lower cost providers, as frequent plan-switching by patients and the administrative complexity of the arrangements limited the effectiveness of the models, according to RevCycleIntelligence.

Annual Report on the Performance of the Massachusetts Healthcare System: 2019

In 2018, Massachusetts met the Total Health Care Expenditures benchmark set by the Health Policy Commission, growing by 3.1 percent to $8,827 per resident, according to analysis by the Center for Health Information and Analysis. The report also notes that the public insurance program, MassHealth, launched its accountable care organization (ACO) program in 2018 and shifted more than 60 percent of its members to an ACO in that year. Alternative payment model (APM) adoption declined slightly among commercial health plans in 2018, especially within smaller plans.

Marketwide Price Transparency Suggests Significant Opportunities for Value-Based Purchasing

Marketwide price information at the insurer-provider-service levels could help target policy interventions to reduce healthcare spending, according to a simulation reported in Health Affairs. Researchers examined variation in fee-for-service commercial prices in Massachusetts for 291 predominantly outpatient medical services and found that prices varied considerably across hospital service areas. Prices for medical services at acute hospitals were, on average, 76 percent higher than at all other providers. The service categories with the widest price variation were ambulance/transportation services, physical/occupational therapy and laboratory/pathology testing. In this market, simulations suggested that steering patients toward lower-price providers or setting price ceilings could generate potential savings of 9–12.8 percent.

Price Hikes, Upcoding Drive Massachusetts Inpatient Spending

Commercial inpatient healthcare spending has increased in Massachusetts despite declining volumes, according to Modern Healthcare. Commercial inpatient spending across the state grew 10.7 percent from 2013 to 2018, while service use decreased by 12.8 percent, according to a report from the Massachusetts Health Policy Commission. In addition, the average commercially insured patient risk score increased 11.3 percent from 2013 to 2017, which theoretically should have increased intensive care unit and cardiac care unit volumes and lengths of stay. Instead, the data suggest that hospitals are maximizing coding rather than treating sicker patients.

Harvard Pilgrim Health Care and Tufts Health Plan, two of Massachusetts’ largest insurers, sign agreement to merge

Massachusetts second and third largest insurers, Harvard Pilgrim Health Care and Tufts Health Plan, have signed an agreement to merge, according to Mass Live. The two insurers combined would present a formidable challenger to the state's largest insurer, Blue Cross Blue Shield, as the combined company would have revenue excess of $8 billion. However, the merger still requires approval from state regulators, including the Health Care Policy Commission, which oversees healthcare mergers and acquisitions.

ACOs with 2-Sided Risk Can Cut Cost, Improve Quality, Study Finds

Blue Cross Blue Shield of Massachusetts’ Alternative Quality Contract (AQC) population health program with two-sided risk cut per-enrollee spending by as much as 11.9 percent compared to a control group, according to Healthcare Dive. Researchers from Harvard and Tufts University medical schools, Massachusetts General Hospital and Haven Boston, published a study in the New England Journal of Medicine looking at eight years of AQC data. Along with the cost savings, the quality of care improved – researchers saw a 7-percentage point increase in patients with diabetes receiving high quality disease management after the AQC program was implemented.

Medical Errors Prevalent and Costly, New Survey of Massachusetts Residents Shows

Twenty percent of Massachusetts residents have experienced a recent medical error and most of them said they “feel abandoned or betrayed by their doctor,’’ according to a survey summarized in the Boston Globe. Researchers estimated that 61,982 errors occurred in a single year, costing $617 million in follow-up care patients needed as a result of the mistakes. Despite a law that requires healthcare providers to disclose medical errors that cause significant harm and encourages them to apologize, only 19 percent of residents who reported an error said they received an apology. The survey, conducted by the Betsy Lehman Center for Patient Safety – a state agency – is one of the most comprehensive statewide examinations of medical errors to date.

State Report: Drug Benefit Managers are Driving Up Healthcare Costs

Drug benefit managers are increasingly profiting off pharmacies and insurers, driving up Massachusetts’s spending on healthcare, according to the Boston Business Journal. A new state report, issued by the Health Policy Commission, shows that pharmacy benefit managers have bolstered their own profits through a practice of “spread pricing” - negotiating a far lower price than what it passes on to the insurer. In 2017, total prescription drug spending at pharmacies grew 4.1 percent in Massachusetts – one of the highest healthcare spending increases in the state.

New Massachusetts Bills Propose Telehealth Insurance Coverage, Practice Standards

There is momentum and support to continue to build telehealth commercial coverage. Massachusetts legislators filed five new telehealth bills for consideration, according to the National Law Review. Four of these proposed bills directly compete with each other, so it will be important to monitor their progress through committee and reconciliation. All of the bills state that insurers (including Medicaid MCOs, Massachusetts Group Insurance Commission, Individual plans, Hospital service plans, HMOs and PPOs) must not decline to provide coverage for health care services solely on the basis that the services were delivered through telemedicine. While it is not yet clear which bill will prevail, it is clear that Massachusetts is continuing to explore ways for policy to drive innovation in health technology, while balancing patient safety and the insurance industry.

Urgent Care Centers Proliferate in Mass., But Fewer Low-Income Patients Have Access

Urgent care centers and walk in clinics that treat a range of medical issues are proliferating, especially in affluent suburbs of Massachusetts, according to the Boston Globe. A state commission counted 150 urgent care centers last year, up from 18 in 2010, reshaping the healthcare landscape in Massachusetts, promising to treat non-life-threatening medical conditions without appointments at a fraction of the cost of ERs. But companies are not rushing to open urgent care centers in the lower-income neighborhoods in Boston. Only a small fraction of their revenue comes from patients on Medicaid, which insures more than one quarter of the state's residents. 30 to 40 percent of centers refuse to treat Medicaid patients, saying the program's requirements are onerous and does not pay enough to cover their costs. The state generally will not pay for residents on Medicaid to visit an urgent care center unless the patient has a referral from a primary care doctor, a burdensome requirement which can prevent the urgent care companies from treating large numbers of low-income patients. MinuteClinics began operating in Massachusetts more than a decade ago, and are regulated by the state, while urgent care centers are still new enough to Massachusetts that the state has no official definition for them, nor specific rules for how they operate.

Blue Cross Wants to Reward Hospitals — For Keeping Patients Out of Hospitals

Blue Cross Blue Shield of Massachusetts, the state's largest health insurer, is trying a new strategy to tackle healthcare costs: putting hospitals on a budget, according to the Boston Globe. Blue Cross will be paying hospitals not per patient and procedure but for how well they control costs while trying to keep patients healthy, rewarding hospitals when they collaborate with physician groups to manage costs and improve outcomes. Hospitals are still rooted in a fee-for-service system and represent the biggest portion of healthcare costs (accounting for more than one third of the $61.1 billion in MA) so this shift in incentives in the hospital system is historic. Blue Cross is testing the model with South Shore Hospital in Weymouth, and if it goes well it will begin to offer the program to other Massachusetts hospitals by 2020.

Growth in State Health Care Spending Drops to Lowest Level in Five Years

Massachusetts made progress in controlling healthcare costs, according to a recent report. Total health spending increased 1.7 percent in 2017, the lowest the state has seen in the past five years, though healthcare costs remain a burden for many residents. A 2012 state law requires Massachusetts to contain the growth in medical spending to 3.6 percent a year, and the chairman of the state Health Policy Commission said this report shows Massachusetts is leading the country in lowering the rate of growth in medical spending. The president of the Massachusetts Association of Health Plans noted that “This is good news for employers and consumers, but today’s report also demonstrates that more work needs to be done to address health care cost drivers in our marketplace.”

Why Boston Medical Center is Investing In Housing

Chuck Gyukeri is a Navy vet who was homeless in 2009 and has been living in subsidized housing since then, but he now lives in a small apartment in Dorchester, supported by disability benefits and a Section 8 voucher, according to WBUR. One third of the units in this housing unit are uninhabitable, but an $800,000 investment from Boston Medical Center (BMC) will hopefully turn this building into a center for healthy living. Housing as a social determinant of health is one way we can invest in our population’s health and ensure healthy living, since medical care only makes up about 10% of a person’s health. BMC has invested around $6.5 million dollars into housing in Boston’s poorest areas to improve Boston’s social determinants of health.

The Use of Online Price Transparency Tools Lags in Massachusetts

Four years ago Massachusetts signed a law mandating health insurers in the state develop a database and online tools to enable consumers to research and comparison shop prices for healthcare procedures four years ago, according to Digital Commerce. Over three years, the total number of procedures that the state's three biggest health insurers let consumers price online has grown to 3,052, including 1,568 from Blue Cross Blue Shield, 800 from Harvard Pilgrim and 684 from Tufts. Price transparency can help initiate reforms to reduce healthcare costs and allow market forces to drive patients to lower-cost, higher value providers. More Massachusetts consumers are using the websites of these healthcare payers, more work remains on healthcare price transparency. For example, the estimator tools do not provide cost data on many behavioral health procedures, and none of the tools are readily available in a language other than English. The health insurers are actively looking for ways to increase use of the online tools and comparison shopping for procedures, like rewarding employees for choosing lower-cost high-value providers.

The Evolution of Health Insurer Costs in Massachusetts, 2010–12

Between 2010 and 2012 in Massachusetts, Health Maintenance Organizations (HMOs) used physician cost control incentives but Preferred Provider Organizations (PPOs) did not, and the HMOs had a slower cost growth, according to researchers from Columbia University and Harvard University. Researchers were looking at the evolution of health insurer costs, paying attention to the composition of enrollees and determined that cost growth cannot be understood without account for (1) consumers' switching between plans and (2) differences in cost characteristics between new entrants and those leaving the market. Over the period of this study, HMOs were using a global payment model and had a slower cost growth than the PPOs who did not have a global payment model for their physicians. However, healthy patients were also switching over to HMO plans and sicker patients were switching out of them. When these factors were controlled for in the study, there was substantially higher growth costs for all plans, though growth was still higher for PPOs than HMOs. This demonstrates a need to test global payments into larger market to evaluate the relationship of physician incentives in changing market structures, prices, and referrals.

Massachusetts Healthcare Spending Varies Widely

A new report by the Massachusetts Health Policy Commission highlights widespread variation in per patient spending among the state's 14 largest healthcare providers, according to Modern Healthcare. Providers affiliated with academic medical centers generally spent more than other types of organizations, with spending differences between the highest and lowest cost providers exceeding $1,500 per patient. The commission recommended bolstering competition, increasing transparency, improving incentives for payers and purchasers to seek out high-value care, and implementing alternative payment models to reduce variation.

Findings From the 2017 Massachusetts Health Insurance Survey

Though Massachusetts had a much lower uninsurance rate than the nation in 2017 (3.7 percent), healthcare costs remained a concern for many, according to the 2017 Massachusetts Health Insurance Survey from the Center for Health Information and Analysis. More than one in four respondents reported an unmet need for medical or dental care in the past 12 months due to cost and almost one in 10 respondents with insurance coverage all year spent more than 10 percent of family income on out-of-pocket healthcare costs, not including premiums. In addition, the 2017 survey introduced questions on medical errors, revealing that nearly one in five respondents reported a medical error occurred in the past five years in their care or in the care of a household member or an extended family member outside of the houshold. These errors generally had health consequences, with over half of those reporting an error saying the most recent error had serious health consequences.

MassHealth Partners with 17 Health Care Organizations to Improve Healthcare Outcomes for Members

Seventeen healthcare organizations in Massachusetts have agreed to participate in a major restructuring of the MassHealth program, according to a press release from the state’s Department of Health and Human Services. Effective March 1, 2018, participants—including Accountable Care Organizations (ACOs), physician networks, hospitals and other community based healthcare providers—will be financially accountable for cost, quality, and patient experience of more than 850,000 MassHealth members. “Historically, MassHealth has operated under a fee-for-service model that leads to gaps in care and inefficiencies,” said the state’s Assistant Secretary and Director of the MassHealth program. “Under this new model, MassHealth will be partnering with provider organizations directly to deliver coordinated, quality care to members.”

State Budget Includes New Fees on Businesses to Help the State Pay for Healthcare Costs

State lawmakers approved an annual budget that imposes new fees on businesses to help pay the state’s rising healthcare costs, despite rejecting a set of controversial proposals from the Governor’s office to rein in those costs, reports The Boston Globe. Advocates for the poor applauded the Legislature’s decision to leave out policy changes they said would have hurt families who rely on public health coverage. But employers argued it was unfair of lawmakers to ask them to pay more without also taking steps to attack the underlying costs of the state Medicaid program.

Massachusetts Care Still Expensive; Health Costs 2nd Highest in U.S.

Massachusetts has dropped behind Alaska when it comes to most expensive healthcare spending by state, according to the Boston Herald. Although average hospital spending and average physician spending in Massachusetts were higher than the U.S. average, growth rates were down sharply for both measures since 2009. The state lowered its spending relative to the national average for hospitals, physicians and nursing care, but saw increases in drug spending and a spike in home health spending.

Commonwealth Care Alliance Shows Promise in Managing Complex Patients

Massachusetts began the Commonwealth Care Alliance four years ago with the goal to manage care for some of the poorest and sickest people in the state. The Boston-based program has begun to show success in treating this complex population and reducing costs, according to the Boston Globe.Hospital admissions for members enrolled in the program for at least 18 months have dropped by 22 percent.

Special Commission on Provider Price Variation

The Special Commission on Provider Price Variation for Massachusetts spent 6 months tackling complex issues in healthcare, including the payer-provider contracting relationship, the impact of healthcare market forces, how transparency can be implemented meaningfully, and a potential role for the state in reviewing provider rates, according to a press release from the chairmen of the Massachusetts Committee on Health Care Financing. The report details market forces affecting Massachusetts specifically, but also discusses the market in relation to Rhode Island, Maryland and Vermont with specific programs like All-Payer Rate setting. This comprehensive report concludes with recommendations ranging from defining warranted and unwarranted factors in price variation to State Monitoring Recommendations.

Health Price Cap Plan May be Seen as a Hybrid Between Free and Regulated Market

Wary that existing and future federal regulations won’t do enough to make healthcare affordable, a proposal by the Massachusetts governor would cap the prices many hospitals, doctors and labs are paid for the next three years, according to WBUR. Providers would be divided into three categories based on price, with lower-priced hospitals eligible for rate increases and highest-price providers ineligible for increases.

Massachusetts Launches Digital Healthcare Council

Massachusetts will launch a new public-private partnership that will advise Governor Baker’s Administration on how it can use technology to improve healthcare quality and reduce costs across Massachusetts, according to HealthcareITNews.

Massachusetts Hospitals Receive Poor Grades for Safety

One out of six Massachusetts hospitals received poor grades on safety measures in ratings released from the Leapfrog Group, according to BizJournals. Medical harm transparency is important for patients to know how well hospitals protect them from injuries and infections.

Report Finds Little Evidence of the Impact of Massachusetts Hospital Community Benefit Investments

Massachusetts' tax-exempt hospitals invest more than a half-billion dollars annually into community benefit programs, but there is little evidence of the effectiveness of those investments and whether they benefit the communities served, reports Community Catalyst. A new study--entitled Hospitals Investing in Health: Community Benefit in Massachusetts--examines the current state of hospital community benefit programs and offers recommendations to strengthen their coordination, transparency and impact. Recommendations include increased coordination and transparency and redirection of resources to address social and economic needs of communities.

NEHI Community Health Needs Assessment of Greater Boston

A new report released by the NEHI concluded that hospitals across the Greater Boston Area are performing Community Health Needs Assessments independently. The report further suggested that a greater impact would be made if the hospitals could join efforts and work collaboratively. The hospitals agreed on the greatest health issues but lacked clarity on how to address these issues.

Massachusetts Health Co-Op Sues over Health Law Formula

According to The Wall Street Journal, Minuteman Health of Massachusetts, a health co-op, has filed a lawsuit against the Obama administration over the Affordable Care Act’s risk adjustment formula. Similar lawsuits across the nation have been filed stating that the administration mishandled the program and created an inaccurate formula that overly rewards big insurers.

Massachusetts Awarded Waiver to Help Prevent Premium Hikes

Massachusetts has been awarded a waiver from HHS that could help prevent health insurance premium spikes for the next year, according to the Boston Herald. The waiver lets businesses continue using rating factors that may not align with the Affordable Care Act.

HCFA’s Report Card on Insurers’ Consumer Costs Web Sites

A 2012 law required insurers and third party payers to provide a website to members with prices and the member’s estimated cost sharing for health care services. Health Care for All Massachusetts assessed the tools from the state’s largest three insurers to create a report card comparing how well the tools aid in decision-making, accessibility and comprehensiveness.

Addressing Price Variation in Massachusetts

A Health Affairs blog post analysed current price variation among providers and ongoing efforts within the state to decrease this unwanted variation. While Massachusetts is a leader throughout the country in taking the necessary steps to curb rising healthcare costs, more work needs to be done to reduce this variation.

Bill to Rein in Drug Costs Spurs Controversy

The lead sponsor of a Massachusetts bill calling for some of the nation’s most sweeping steps to control prescription drug costs scrapped a controversial provision that would have capped prices on treatments for critical illnesses such as hepatitis C, according to the Boston Globe. “It’s nearly impossible for policy makers, regulators and regular consumers to know the true markup on drug prices,” the Hub’s Lynn Quincy said, suggesting the factors that go into calculating drug prices have long been “shrouded in secrecy” in the United States.

Massachusetts Considering Legislation for Single-payer Healthcare System

Massachusetts is debating a bill that would move healthcare coverage from private companies to a single-payer system where the state would insure all of its citizens, according to an article in Townhall. Despite the passage of the Affordable Care Act in 2010 many Massachusetts citizens still do not have healthcare coverage. Neighboring state Vermont has tried similar legislation, though lawmakers decided that it was ultimately not the time for Vermont to become a single payer state.

Even With Insurance, Mass. Residents Often Can’t Afford Care

Nearly all Massachusetts adults have health insurance, but being insured is no guarantee patients can afford health care or even find someone to provide it, according to the Boston Globe. A report from the Urban Institute found that despite the state’s landmark healthcare overhaul, the report found, cost and access remain problems for a significant share of residents.

State Considering How to Increase Hospital Transparency

Recent reports that underscore persistent variations in healthcare prices charged by different Massachusetts hospitals have led to renewed calls for greater transparency around what patients pay for medical services. The Massachusetts Legislature has mandated the creation of a price and quality transparency website but the state’s Center for Health Information and Analysis is having difficulty identifying what healthcare data consumers need in a price transparency tool.

Massachusetts Health Policy Commission Issues 2015 Cost Trends Report

The Massachusetts Health Policy Commission released its 2015 Cost Trends Report. The report contains comprehensive data on the commonwealth’s healthcare spending across all private and public payers, detailed analyses of multi-year spending trends, and key insights about the strengths and weaknesses of the healthcare delivery system across Massachusetts’ communities. The report offers 13 major recommendations, including a reduction in unwarranted variation in provider prices, enabling consumers to make high-value choices, enhanced transparency of drug prices and spending and advancing alternative payment methods.

1 In 6 Mass. Residents Put Off Healthcare This Year To Avoid Costs

A new survey of Massachusetts residents finds that about one in six did not get healthcare they said they needed in 2015 because of the cost. The survey from the state’s Center for Health Information and Analysis highlights a trend showing more people have high-deductible plans in which insurance covers less care and patients pay more out of pocket.

AG Says State Must Do More To Control Healthcare Costs

Massachusetts is unique in their commitment to tracking statewide health spending but the state will miss a self-imposed annual healthcare spending target, according to public radio station WBUR. A report from Attorney General Maura Healey finds little change in problems that have been contributing to high costs for years: some hospitals are paid a lot more than others, patients prefer the expensive hospitals and efforts to change the way we pay for healthcare have not yet done much to shift spending.

Capped Drug Prices Won't End the Rise of Health-Care Costs

Philadelphia Inquirer: Massachusetts’ lawmakers are considering a law that imposes price limits on some of the most expensive medications and would make Massachusetts the first state to cap drug prices. New York, California and Pennsylvania are also considering similar bills.

Insurers asked to improve health cost websites

Healthcare For All, a leading health advocacy organization in Massachusetts, released an evaluation that analyzed the criteria for accessibility, comprehensiveness and guiding decisions for the required price transparency regulations enacted in 2012. Doctors, hospitals, and health insurers are all required to provide cost estimates upon request and Healthcare for All evaluated the top three insurers in the state and found that there is a still a lot of space for improvement in all three websites.

Effect of Massachusetts Healthcare Reform on Racial and Ethnic Disparities in Admissions to Hospital for Ambulatory Care Sensitive Conditions: Retrospective Analysis of Hospital Episode Statistics

This BMJ report analyzed hospital admissions from 2004, two years prior to health reform, to 2009, two years after implementation. The report found that expanding health insurance coverage did not result in fewer hospitalizations or change disparities in admission rates between different races.

Hospital Network Competition and Adverse Selection: Evidence from the Massachusetts Health Insurance Exchange

This working paper by Mark Shepard identified adverse selection implications associated with plans covering prestigious academic hospitals. As a result, plans may limit networks and challenge these prestigious hospitals to lower prices.

2013 Massachusetts Health Reform Survey

This report, completed yearly, tracks the progress of the state’s healthcare system and the impact of the recent health reform measures. In 2013, at the time of this survey, coverage remained high with 95 percent of Massachusetts adults participating in health plans. Affordability challenges continued to exist at levels observed in 2006, with one in five adults reporting problems paying medical bills. Reported access to healthcare slightly declined since the implementation of health reform; however reported healthcare quality increased. The report identifies the single greatest opportunity for the healthcare system is to address the burden of healthcare costs, especially for low-income families.

How Much Is That MRI, Really? Massachusetts Shines a Light

NPR covers how the price transparency measures included in the 2012 reform requiring private insurers to post price estimates online, such as the tool available through Harvard Pilgrim Healthcare. These tools allow consumers to browse price differences among providers. As a result, patients with the incentive to shop now have resources to utilize when trying to spend less.

Massachusetts Makes the Biggest Push Yet to Make Health-Care Prices Public

This Governing article summarizes the transparency measures beginning in October 2014 as a result of the 2012 reform aiming to implement cost controls. Private insurers are required to post price estimates for services online and physicians must provide price estimates to consumers who ask. Concerns remain as to how accurate these prices are and how patients may be responsible for additional hidden fees. At this time, price information is only required to be available to plan members, compared to New Hampshire’s practice of comparing between insurers as well. Quality measures are a critical next step in transforming these cost estimates to value measures.

Massachusetts Exceptionalism -- A Forum on Costs

This Boston Globe article reflects on the dynamics between the Greater Boston Interfaith Organization, a consumer group, and Massachusetts hospitals as they navigate health reform. Both groups are working together to achieve high quality, affordable care. The author suggests these kinds of engagement and collaboration are necessary in meeting the new state mandated limits on healthcare cost growth.

Examination of Healthcare Cost Trends and Cost Drivers, 2013

The Attorney General’s third report examining cost trends in Massachusetts identified consumers increasingly participating in tiered and limited networks, PPO and high-deductible plans, typically the cheapest options available to consumers. Growth in prices of medical services is the primary cost driver within the state and there continues to be a wide variation observed in prices. Providers are increasingly taking on insurance risk and aligning with other entities, potentially negatively impacting the market.

Examination of Healthcare Cost Trends and Cost Drivers, 2011

The Attorney General’s second annual report examining cost drivers in the Massachusetts healthcare market with specific focus on the cost containment resulting from the inclusion of global payments. The study found continue wide price variation between providers not explained by differences in quality of care, globally paid providers do not consistently lower total medical expenses, total medical spending is higher for people with higher incomes, tiered network products have increased consumer engagement in value-based purchasing decisions, PPO products produce significant barriers to providing coordinated care and providers designed around primary care and global payments may encourage coordinated care; however, global payments pose significant challenges.

Massachusetts Attorney General Drops Health Reform Bombshell

This WBUR article reflects on the Attorney General’s new findings that global payment reform may not result in lower total medical expenses, as expected. In reality, the reform has led to increased health costs, increasing payments to two provider groups by more than 26 percent between 2008 and 2009. Wide price disparities continue to exist within the Massachusetts healthcare market and are based on providers’ reputation rather than quality differences. Despite the increases observed, insurers believe cost savings may be observed in the long run.

Examination of Healthcare Cost Trends and Cost Drivers, 2010

The Attorney General’s first annual report examining cost trends and cost drivers in the Massachusetts healthcare market with the goal to identify, understand and explain why costs are escalating faster than general inflation. The report found price increases is the chief cost driver in Massachusetts over the last few years and that prices vary significantly within the same geographic area, unrelated to quality of care, the health of the population,the kind of facility care is received or delivery costs. These price variations were found to correlate with provider market power. The report calls for increasing transparency and standardization, improving market function, engaging consumers with decision-making tools and prompt action prohibiting insurer-provider contracts perpetuating market disparities.